Debt Consolidation vs Personal Loan Singapore Which Option Suits Your Finances?

The cost of living in Singapore has been rising, and with it comes the challenge of managing different financial commitments. Many households and young professionals are juggling credit card balances, personal loans, and sudden expenses. In such cases, two solutions often appear: taking a personal loan Singapore or using a debt consolidation plan.

Both choices can reduce financial stress, but they serve different purposes. Choosing between them means knowing how each works, who qualifies, and the long-term effects. This guide explains the differences and helps you decide which option may fit your needs best.

Understanding Personal Loan Singapore

A personal loan is an unsecured loan. It gives you a lump sum of money that you repay in fixed monthly installments. Since it is unsecured, you do not need to pledge property as collateral.

Common uses of personal loans include:

- Covering medical expenses or emergencies

- Funding education costs

- Renovation or wedding expenses

- Managing temporary cash flow gaps

Both banks and licensed moneylenders in Singapore provide personal loans. To qualify, borrowers must show proof of income, residency, and identification.

Licensed lenders like Cashmart Singapore are regulated by the Ministry of Law. They follow strict rules to ensure transparency. Their loan packages have clear repayment schedules, which make it easier for borrowers to plan responsibly.

What is Debt Consolidation?

Debt consolidation means combining many debts into a single repayment plan. Instead of paying several credit card bills or personal loans at different interest rates, you roll them into one loan.

Benefits include:

- One monthly repayment instead of many

- Lower effective interest rates

- Easier budgeting and planning

According to SingSaver (2023), credit card interest rates in Singapore average 25–28% per year, one of the highest consumer debt costs.

Based on MoneySense (2023), if you owe S$5,000 at 25% per year and only pay the minimum each month, it could take over 14 years to repay. You would also end up paying almost three times the original amount.

Eligibility for debt consolidation can be stricter. Banks often require higher income and significant unsecured debt. Licensed moneylenders may give other options to borrowers who do not meet bank rules.

MoneySmart (2024) notes that Debt Consolidation Plans in Singapore usually have interest rates of 7.7% to 11.08% per year, much lower than credit card rates.

Key Differences Between Debt Consolidation and Personal Loan Singapore

Here is a simple comparison:

| Feature | Personal Loan Singapore | Debt Consolidation Plan |

| Purpose | Flexible, can be used for education, medical needs, or emergencies | Specifically to combine and repay debts |

| Eligibility | Based on income, credit history, and residency | Requires large existing debt and stricter income rules |

| Interest Rates | Vary by lender and loan tenure | Usually lower than credit card debt |

| Repayment Flexibility | Fixed tenure, flexible usage | Structured repayment plan only for debt |

Purpose and Use Cases

Personal loans are helpful when you need money for things beyond debt repayment, such as medical bills or large purchases.

Debt consolidation is best for combining and managing many debts into one plan.

Eligibility and Requirements

Banks usually demand higher income and good credit history for debt consolidation. Licensed moneylenders may provide easier access for people who do not meet those conditions.

Repayment Flexibility

Debt consolidation locks you into a single repayment plan. Personal loans give you freedom in usage but require discipline to avoid overspending.

Interest Rates and Fees

Interest rates differ between lenders. Debt consolidation usually lowers the average rate compared to credit card debt. Personal loans may provide more flexibility if your priority is spending beyond debt repayment.

According to Online Credit (2024), Singapore’s household debt per person is about S$55,112, one of the highest in Asia. This shows why structured repayment is important.

Banks vs Licensed Moneylenders: Key Differences

When deciding between a bank loan and a licensed moneylender in Singapore, it’s important to understand the differences:

| Feature | Banks | Licensed Moneylenders |

| Approval Speed | Slower (usually 3–7 working days, due to stricter checks and documentation) | Faster (can approve within 24 hours, some even same-day disbursement) |

| Maximum Loan Amount | Higher (up to 4–10x monthly income, depending on credit score and relationship with bank) | Lower (usually capped at 6x monthly income, depending on regulations and borrower’s profile) |

| Flexibility | Less flexible (fixed repayment terms, stricter eligibility rules) | More flexible (customized repayment schedules, easier access for those with lower credit scores) |

| Interest Rates | Lower (typically 3–8% p.a. for personal loans; 7–11% for debt consolidation) | Higher (capped by law at 4% monthly, but often more accessible for urgent needs) |

| Eligibility | Higher requirements (good credit score, stable income, no major debt defaults) | Lower requirements (proof of income & residency, more lenient on credit history) |

Takeaway: Banks are best for larger amounts and lower rates if you qualify, while licensed moneylenders provide faster approval and flexibility, though at a higher cost.

Pros and Cons of Each Option

Personal Loan Singapore

Pros:

- Flexible usage for many needs

- Quick access to funds

- Multiple tenure options

Cons:

- May cost more overall if mismanaged

- Not designed for long-term debt repayment

Debt Consolidation

Pros:

- One repayment instead of many

- Lower effective interest rates

- Easier to track debt progress

Cons:

- Stricter requirements

- Cannot be used for other purposes

- Long-term commitment with less flexibility

How to Decide Which Option Fits Your Situation

The right choice depends on your priorities. Here are two examples:

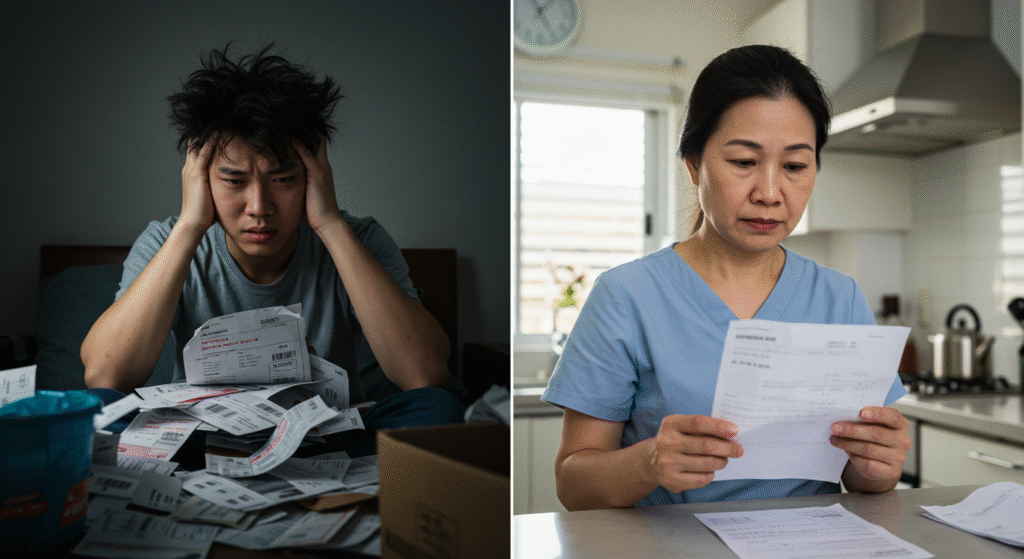

Example 1: The Young Professional

Alex has three credit cards with high balances. He struggles to manage different payment dates. A debt consolidation plan could simplify his payments and lower his interest costs.

Example 2: The Parent Facing Unexpected Expenses

Mei Ling needs money for her child’s medical procedure. She does not have multiple debts but needs cash quickly. A personal loan Singapore is the better choice for her.

Licensed lenders such as Cashmart Singapore often provide loan calculators to help borrowers estimate repayment schedules before they commit.

Responsible Borrowing in Singapore

No matter which option you choose, borrowing responsibly is key. Always:

- Check that the lender is licensed under the Ministry of Law

- Borrow only what you can repay

- Compare terms, fees, and penalties carefully

Loan sharks, or unlicensed lenders, may offer fast cash but charge unfair rates and use harmful methods. Licensed providers like Cashmart Singapore follow strict rules to protect borrowers.

Choosing the Right Path Forward

Personal loans and debt consolidation plans are both powerful tools, but they solve different financial challenges. A personal loan offers flexibility for one-time needs, while debt consolidation provides structure for those with many debts to manage.

The right choice depends on your current situation and long-term goals. Take time to compare lenders, review terms closely, and ensure that any repayment plan supports your financial stability, not strain it.

Trusted and licensed institutions such as Cashmart Singapore provide not only loan products but also educational resources to guide borrowers. By approaching borrowing with the right information, you can turn these tools into stepping stones toward financial freedom, not added stress.

Whether you choose debt consolidation or a personal loan, always compare terms carefully and borrow within your means — that’s the key to long-term financial stability in Singapore.

Frequently Asked Questions

1. Is a debt consolidation plan better than a personal loan in Singapore?

It depends. If you have multiple high-interest debts (like credit cards), a debt consolidation plan usually reduces your interest costs and simplifies payments. If you need funds for a one-time expense (medical bills, education, renovation), a personal loan is more suitable.

2. Can I apply for debt consolidation if I already have personal loans?

Yes, as long as your total unsecured debt meets the bank’s criteria. However, the debt consolidation plan will cover and restructure those loans into one repayment.

3. Will applying for a personal loan or debt consolidation affect my credit score?

Yes. Both applications trigger a credit check. Timely repayments will improve your credit rating, while missed payments can harm it.

4. How do I know if a moneylender is licensed in Singapore?

You can verify the lender through the Ministry of Law’s Registry of Moneylenders. Avoid unlicensed lenders (loan sharks), as they often charge illegal rates and use harassment tactics.

5. What’s the fastest way to get a loan in Singapore?

Licensed moneylenders typically process applications much faster than banks. For urgent needs, they may approve and disburse loans within the same day.